As you no doubt know, this is a blog about personal finance with a leaning towards getting yourself out of debt, staying out of debt, and learning how to handle the money you make once you’re out of debt. There are lots and lots of ways to get out of debt. My personal favorite is pretty close to the Dave Ramsey “Total Money Makeover” method. Not everyone is willing or able to go “gazelle intense” and bust their debt down to nothing the TTM way though. For some, they’ve gotten so far down into that debt black hole that they just don’t know where to start. Those people will, more often than not, end up at a bankruptcy hearing long before they’ll be exclaiming “I’m debt free!” on the radio.

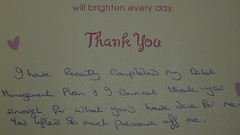

But, if you’re one of those people, there’s one last stop on the debt freefall before you declare bankruptcy. Call it a last ditch effort if you will. That stop is a Debt Management Plan. Too often, the DMP is associated with shysters posing as financial advisors who promise to get you out of debt, while loading you up with fees on the backend. The problem with a DMP that charges fees is that you are actually adding on extra debt as you try and pay off your debt. But, there are some reputable places that do offer a free debt management plan. There are some that will help you to pay off your debt without going into further debt and without declaring bankruptcy.

What exactly is a debt management plan? The administrator of a DMP acts as your agent. They contact all of your debtors, like credit cards, auto loan lenders, etc… and negotiate a payoff schedule with a payment that you can afford. Usually, that payoff schedule will include some pretty significant drops in the interest rate as well. You make one large payment to the DMP agency, and they distribute the payments out to your debtors. At the end of the DMP, you’ve paid off all of those accounts. Any good DMP will require that you don’t add any new debt while on the plan. It also will include at least a minimal amount of counseling to help you avoid getting back into debt when you’ve finished with the debt management plan.

A debt management plan isn’t perfect. It’s not the ideal way to get rid of debt, but for some, who are having issues getting their debt under control, or, issues making all their payments, they can be a valid way to go about doing so without the pain of bankruptcy. Your credit will still take a hit, however. Not nearly the hit that a bankruptcy would deliver, but the accounts will get reported as being negotiated.

In the end, if your choice is between a debt management plan and bankruptcy, I’d take the DMP any day.

Shane Ede is a business teacher and personal finance blogger. He holds dual Bachelors degrees in education and computer sciences, as well as a Masters Degree in educational technology. Shane is passionate about personal finance, literacy and helping others master their money. When he isn’t enjoying live music, Shane likes spending time with family, barbeque and meteorology.

I worked for a while as a counselor at a credit counseling agency that administered Debt Management Plans, and you’re right: They can be a good solution for many. To avoid crooks, people interested in learning more about a DMP can start their search at the website of the National Foundation for Credit Counseling, which keeps a directory of non-profit credit counseling agencies. There should be no cost for credit counseling alone, so no downside to a session with a counselor. Most agencies charge fairly modest fees to set up and administer a DMP (if that’s the option chosen), but the interest saved would dwarf any fees. Keep in mind that even if a consumer’s credit card companies have declined the consumer’s request to put him or her in a hardship program or make any concessions, a reputable credit counseling agency will likely have success in gaining concessions with this same creditor when working on behalf of the consumer.

So is this the same as a credit consolidation? Or this this a new twist on that?

@James Close. A credit consolidation generally gets you one loan that you use the proceeds to pay off the other lenders with. With a Debt management plan, it’s just the dmp administrator negotiating with the lenders and then administrating the plan for the entire payoff period.

“In the end, if your choice is between a debt management plan and bankruptcy, I’d take the DMP any day.”

Yes, yes, yes, yes, yes!

I often hear stupid “you can declare bankruptcy” ads and want to strangle them.