The following post is sponsored, and I am being compensated to write it. That doesn’t change the fact that I’m doing a review, and it will be honest.

When I was first asked to do a review of Weemba, I’d never heard of it. (See? Honesty!) As any good reviewer will do, the first thing I did was try and figure out just what it was that I was to be reviewing. I’ll extrapolate later on, but here’s how they put it in a recent press release.

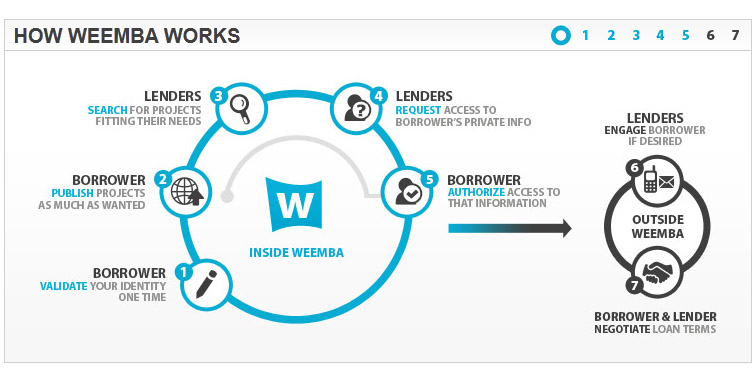

Weemba revolutionizes the way borrowers and professional lenders connect via an online financial platform. Weemba provides, by means of unique proprietary methods and state-of-the-art safeguards, a virtual way for borrowers to post their needs and for lenders to then find those borrowers. Protected by a nickname, borrowers post project profiles for lenders to review; interested lenders ask borrowers to access their private information, and if granted access, can contact borrowers directly. Weemba facilitates the borrower-lender interaction without interfering in the negotiation process.

It sounded a bit like a peer-to-peer solution, which, as I’m sure you’ve read, I’m a fan of, so I figured I’d give it a review. (Doesn’t hurt that I was paid to do it too.)

Sign-Up

Signing up for Weemba was pretty easy. In fact, if you so choose (I did.), you can sign up using your Facebook account. You create a Community ID which will be used for their forums and support, and give them the necessary personal details. If you’ve ever filled out a loan application, you know what I mean. Name, address, SSN, etc. There’s also the multiple-choice questions that they pull from your credit info (from Equifax) to verify you are who you say you are. That’s it. Fill in the info, verify, and you’re off.

Adding a Loan Project

Once you’ve completed the sign-up process, you’re taken directly to the loan project creation page. You’re asked to choose between a personal and business loan type. I chose personal, but they do have the system in place for both. I advance through, and then get down to the nitty-gritty of the loan project. Give it a name, tell the lenders what type of loan it is, how much you want, what amortization method you’d like (Installments, Balloon, or Lump Sum), the desired length of the loan, funding type (Full funding only or partial funding accepted), and then are given the option of adding your Equifax Credit Score.

I balked a bit here. If you know how the credit score programs from any of the credit bureaus normally work, you’re usually signing up for a free trial to their credit score monitoring service that is followed by a paid service. There wasn’t any mention of whether it really cost me anything or not, so I read the Terms and Conditions. There, it does mention that some of their services do cost a monthly fee, but doesn’t mention any of the services by name, so I still couldn’t be sure. Later, I looked in the FAQs and it does mention there that it’s “no cost”, but with no further details. I don’t see any way around adding your credit score to a legit loan project, so if you’re adding one to seriously pursue a loan, you’ll need to do so. I wasn’t going to publish the loan project, so I didn’t add the credit score.

Once you’ve gotten the credit score added, you get a chance to add details of the loan, some secure info (contact and some advanced qualifiers for their search engine), create a forum for your project, and then add an Avatar or videos to the loan project. The avatar will be displayed in their search results, and on the rotator on their home page. There’s also a “W-SEO” score added to the end. From what I could tell, it looks to be a ranking of sorts based on how much info you filled out, and is dynamically updated after the loan is published with info on conversation, ratings, etc.

What I Think

For a company that claims to revolutionize the way “borrowers and professional lenders connect”, I saw a lack of any major revolutionary ideas. Essentially, they act as a loan broker. They do it online, so maybe that’s the revolutionary part? I kind of thought that Lending Tree did that ages ago, no? Or, maybe it’s the search combined with some decidedly social aspects? I’ll give them that. Sites like Lending Tree basically pull your info and then spit it out to some local lender that you’ve matched with, so giving the lenders the ability to search for some quality borrowers while giving the borrowers some social tools is a good step up. I’m just not sure that it deserves the revolutionary PR jargon. They broker the loan, by facilitating the connection. Once the connection is made, it’s handled privately between the borrower and the lender.

Overall, Weemba looks like a good service that will fill a need both on the borrower and lender side. I’m a big fan of peer-to-peer because it gives the borrowers to make a case for themselves. Something that Weemba does too. I couldn’t find any information on who the lenders are, or if there’s a process for becoming a lender, so I’m assuming that it’s mostly institutions. Still, a good service, that will allow borrowers to find some competitive offers for their lending business.

If you decide to give Weemba a try, here’s a few things I’d make sure to do to better your odds of finding a lender.

- Be honest. If there’s a story behind your debt, or the reason for the loan, share it.

- Add a credit score. I don’t know a lender that isn’t going to hesitate if the loan project doesn’t have a credit score.

- Add a good avatar. Even if it’s a picture of the car you want to buy. A picture is going to help you. Same for video if it applies.

- Answer Questions. If a lender asks a question, or needs clarification, answer it promptly.

What do you think? Would you give Weemba a try? Why? Why not?

I started this blog to share what I know and what I was learning about personal finance. Along the way I’ve met and found many blogging friends. Please feel free to connect with me on the Beating Broke accounts: Twitter and Facebook.

You can also connect with me personally at Novelnaut, Thatedeguy, Shane Ede, and my personal Twitter.

I have to agree with the overall findings–this doesn’t seem to be very revolutionary at all. The only thing different (that I can see at least) is the facebook connect, which may be different for this type of service, but by no means is uncommon these days. I’m surprised there wasn’t a button to tweet “I just signed up to borrow money using Weemba–so should you!”. It may very well be a PR move, since the term “revolutionary” is an attention-grabber.

I have never heard of some of the products that pf bloggers talk about, but from what you and Eric say it doesnt seem like a tech savvy site revolutionizing peer to peer lending. I will pass, thanks for the review.

I could potentially use Weemba in the future. I’ll have to look into all that it offers.

Hi Beating Broke, I’m glad you had a chance to review our site and that you think it’s a good service for borrowers and lenders and we would like to thank you for your thorough analysis. I would like to clarify a couple of concepts though.

The first one is about the credit score. We do say several times that the credit score is given to you at no cost (yes, that’s for free too). We say it in large words at the start of the credit score section of our loan project form and also within the explanation of the credit score service in that form. There is no free trial or monitoring service. We offer the credit score at no cost whatsoever to the borrower as part of our service.

There is no further explanation of the zero cost of the credit score in the Terms and Conditions because it may not be a product we will always have in our platform. This can change in the future.

The main use of the credit score is to make it easy for lenders to find the projects they’re interested in. The openness of the platform allows for professional lenders of all types to register in Weemba, and they may have different credit score requirements for the borrowers they want to service. Therefore, the importance of adding the credit score for the borrowers.

The second one is where you say essentially we act as a brokers. This is not true. A broker closes a deal, like Lending Tree for example. We don’t do that and we don’t even know if the deal was granted to a borrower or not. The deal is privately handled between both parties as you correctly state in your article, but we are not part in that deal, therefore, we’re not brokers in the deal. Please keep in mind that the borrower NEVER fills out an application for a loan. They just provide information that helps to explain the loan project they want to fund. We are an open platform that allows both parties meet on the Internet.

The revolutionary aspect of our platform is that the borrowers can choose who they deal with. The service does not match them with a lender. Lenders find the projects they deem adequate to their lending products and borrowers accept or not to deal with the lenders that contact them. The platform is based on giving maximum freedom for borrowers to bring out into the open their loan projects so a myriad of lenders can see them. There is no forced matching between the parties and Weemba does not apply any criteria to do that. In that sense, we believe it’s a revolutionary platform that allows maximum freedom to borrowers and lenders alike.

Hope the clarification helps.

@Martin Thanks for stopping by, and for the clarification. I must have missed where it says “no cost” in the credit score section. I do believe that if a person is going to use the service, that they will want to include their credit score. Broker might not be an exact match term, but it’s pretty close, in my opinion. No, you don’t close the deal, and it gets handed off to be handled privately, but you act as an intermediary service that does the matchmaking. So, maybe matchmaker would have been a better term. There it is. You’re the matchmaker of the online lending community! 🙂 Any chance you can answer the question on who the lenders are (all banks and credit union?) and how they are selected?

Eventhough I am not a fan of peer to peer lending, the fact that Martin showed up with clarifications is definitely a + for this business.

@BeatingTheIndex It’s not technically peer-to-peer lending, I don’t think. That’s part of why I asked Martin for clarification on who the lenders are. My guess is that the lenders are institutions like banks and credit unions. Aside from the lack of anything that really screams “revolutionary” to me, I think the idea is a good one, and I think it’s something that might gain some traction as people shop for the best rates.

Yes Beating Broke, that’s correct. We are not a peer-to-peer type of operation. The lenders that can register in our site are professionals duly registered and lincensed by State or Federal agencies such as:

Commercial Banks

Savings Banks

Credit Unions

Thrifs

Industrial Loan Companies

Consumer Finance Companies

Direct Mortgage Lenders

Factor.Insurance Companies

Asset-Based Lenders

State-Lic. Non-Depository Lenders

Credit Card Banks

Government Agencies

On another note, I have to insist that we have nothing to do with a broker, at least from a financial point of view. we are definitively not that from a legal point of view and think about this: would you call Facebook a broker of friendships on the Internet? Probably not. We are a platform where people with financial needs meet and once they met they reach their agreements outside of Weemba. Yes, probably more like the matchmaking analogy that you did before.

I’m trying to write again in the forum but I get an error saying the message is duplicated, but it is not. Any hints?

@Martin Thanks for stopping by again, Martin. And, for the further clarification. My guess had been that the lenders were “pro” lenders like banks and credit unions, but didn’t find anything on the site that indicated that. I agree, matchmakers is probably a better analogy than a broker.

@Martin It looks like you were getting caught in the spam filter. I’ve cleared that up, so you should see your message there now, as well as my response. Thanks!