Taxes are a universal part of life, but some taxes are so strange they defy belief. From historical quirks to modern-day oddities, bizarre taxes reveal fascinating insights into the economic and social fabric of different societies. Whether they were designed to modernize a nation, address environmental concerns, or simply boost revenue in unusual ways, these taxes highlight the creativity and sometimes absurdity of fiscal policies around the world. Join us as we explore 12 of the most bizarre taxes from various corners of the globe.

1. Beard Tax in Russia

During the 17th century, Tsar Peter the Great imposed a beard tax to modernize Russian society. Men had to pay for the privilege of keeping their beards. This bizarre tax was meant to encourage clean-shaven faces, aligning with Western European customs. The tax varied based on social status, with higher fees for nobility. Despite its odd nature, the beard tax revealed the Tsar’s efforts to modernize Russia. It also showcased how taxation can be used as a tool for social engineering.

2. Window Tax in England

Introduced in 1696, England’s window tax charged property owners based on the number of windows in their homes. This strange tax led many to brick up windows to avoid higher taxes. The window tax was intended to target the wealthy, as larger houses had more windows. It resulted in darker, less ventilated homes and even impacted architectural designs. The window tax highlights how governments use taxation to address wealth disparity, albeit in a counterproductive manner.

3. Hat Tax in England

England also saw a hat tax in the late 18th century. This tax required people to pay for a license to wear hats. The rationale was that hats were a symbol of wealth and social status. Hat makers had to affix revenue stamps inside each hat to prove tax payment. This bizarre tax targeted affluent individuals and demonstrated how fashion could be a taxable commodity. The hat tax shows how governments find creative ways to generate revenue.

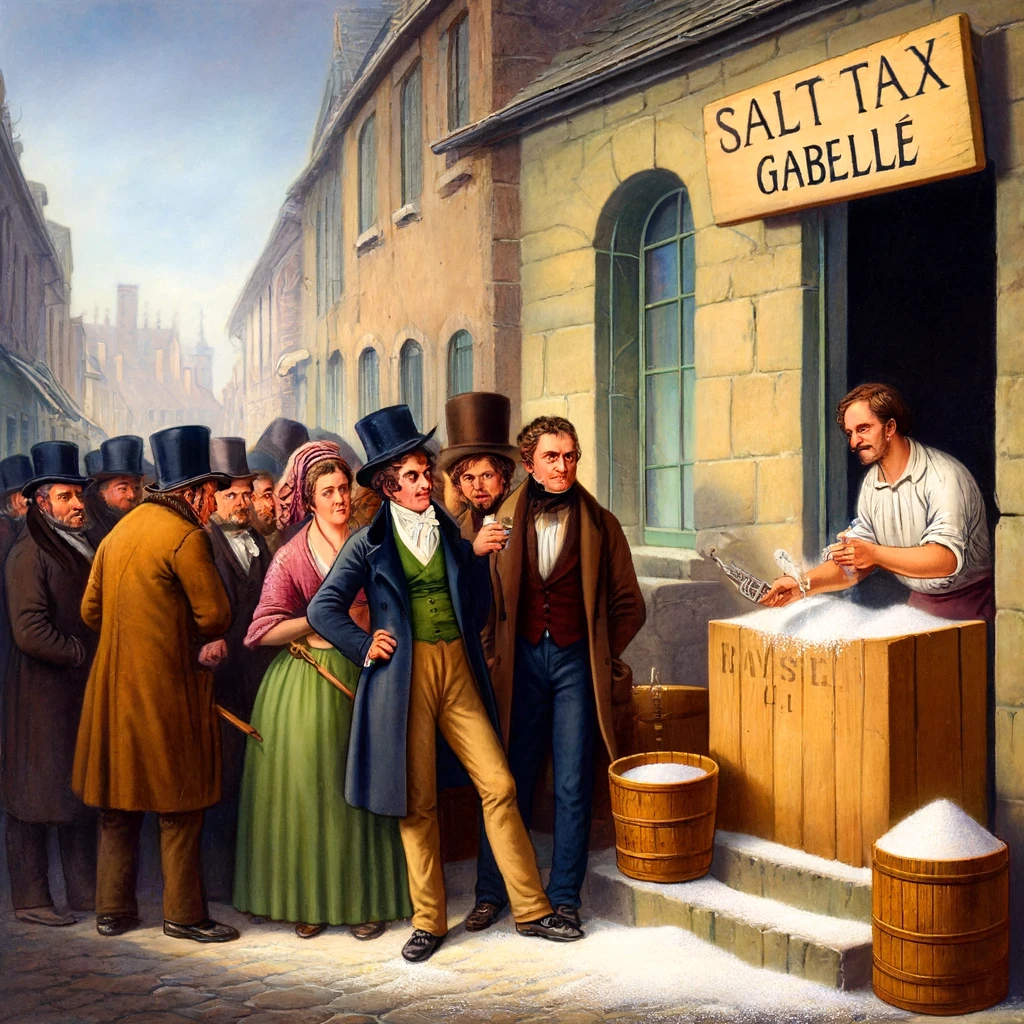

4. Salt Tax in France

France’s salt tax, or “gabelle,” was a controversial levy that existed for centuries. It required citizens to buy a minimum quantity of salt at high prices. The tax was deeply unpopular and contributed to the French Revolution. This bizarre tax underscores how essential commodities can become focal points of economic control and social unrest. The salt tax reveals the impact of burdensome taxation on the populace and the potential for it to spark significant political change.

5. Blueberry Tax in Maine, USA

Maine imposes a tax on blueberries, charging per pound of harvested berries. This strange tax supports the state’s blueberry industry and research. The blueberry tax showcases how specific industries can be targeted for taxation to promote local economies. It also highlights the unique ways in which regions capitalize on their natural resources. This tax reflects how governments use targeted levies to support and sustain key sectors.

6. Cow Flatulence Tax in New Zealand

New Zealand proposed a tax on cow flatulence to address greenhouse gas emissions. While it never passed, the idea was to mitigate environmental impact. This bizarre tax highlights the innovative approaches countries consider to tackle climate change. It also shows the potential for taxation to drive environmental policy. The cow flatulence tax concept illustrates how governments can use taxes to promote sustainability and environmental responsibility.

7. Scutage Tax in England

In medieval England, a peculiar tax known as the “cowardice tax” was imposed on knights and nobles who chose not to participate in military campaigns. Officially called “scutage,” this tax allowed those who preferred not to fight to pay a fee instead. The amount varied based on the rank and wealth of the individual, providing the crown with a steady stream of revenue to fund its military endeavors. This bizarre tax reflects feudal society’s unique social and economic dynamics, where military service was both a duty and a burden. The cowardice tax highlights how medieval governments leveraged fiscal policies to maintain their armies and assert control over their subjects.

8. Witchcraft Tax in Romania

Romania once considered taxing witches and fortune-tellers as part of its revenue-raising efforts. Practitioners would have to pay income tax and contribute to social programs. This bizarre tax highlights how even supernatural professions can be targeted for taxation. It also reflects the government’s attempt to formalize and regulate unconventional occupations. The witchcraft tax proposal shows how far-reaching tax policies can be, extending into the realm of the mystical.

9. Card Games Tax in Alabama, USA

Alabama imposed a tax on packs of playing cards, charging a fee per deck. This strange tax aimed to generate revenue from a popular leisure activity. The card games tax is an example of how everyday items can become taxable commodities. It demonstrates the government’s ability to monetize recreational activities. The card games tax reflects the creativity in taxation methods to tap into various aspects of daily life.

10. Day Trippers Tax in Venice, Italy

Venice, Italy, known for its picturesque canals and historic architecture, introduced a day trippers tax to manage the overwhelming influx of tourists. This tax is levied on all visitors to the city. It aims to discourage short-term visitors and balance tourism revenue with preserving Venice’s fragile environment and infrastructure. The tax helps fund maintenance and conservation efforts, ensuring the city’s unique charm is protected for future generations. This policy highlights the challenges of managing mass tourism in popular destinations and underscores the need for sustainable tourism practices. Venice’s day trippers tax serves as a model for other tourist-heavy cities grappling with similar issues.

11. Wallpaper Tax in England

In the 18th century, England introduced a wallpaper tax, charging based on the number of colors used. This tax led to the creation of simpler, cheaper designs to avoid higher taxes. The wallpaper tax reveals how taxation can influence artistic expression and consumer behavior. It demonstrates the government’s reach into even the most decorative aspects of life.

12. Shadow Tax in Conegliano, Italy

In the historic town of Conegliano, Italy, a unique shadow tax was implemented to optimize the use of public space. This tax charged property owners based on the area of shadows cast by their buildings on public land. The aim was to encourage efficient urban planning and ensure fair use of shared spaces. The shadow tax reveals the innovative approaches local governments can take to manage urban environments. It highlights the balance between private property rights and public resource management. Conegliano’s shadow tax exemplifies how taxation can address unique local challenges in creative ways.

Discover More Bizarre Taxes and Economic Insights!

Exploring unusual taxes provides a fascinating window into the various inventive methods governments use to raise funds. These taxes shed light on the economic imperatives and societal structures of different historical periods and locations. Their exploration offers insights into the diverse and creative ways in which governments have sought to generate revenue. Studying these taxes can help us understand the intersection of economics, governance, and social dynamics.

Read More

Using Your Refund the Smart Way This Tax Season

Tax Deductions for Self-Employed

Shatel Huntley has a Bachelor’s degree in Criminal Justice from Georgia State University. In her spare time, she works with special needs adults and travels the world. Her interests include traveling to off-the-beaten-path destinations, shopping, couponing, and saving.