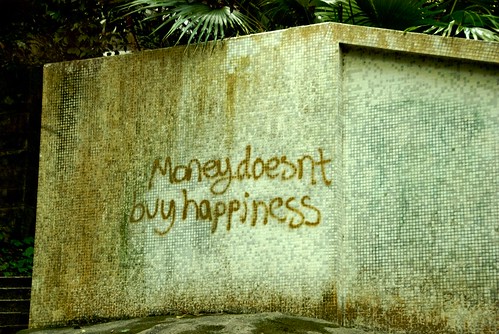

If you’ve read any of the more popular personal finance blogs, books, or attended any of the seminars, one of the more pervasive themes is the idea of enough. Heck, I’ve even written about it before. Just what is enough, or how much is enough. They’ll tell you that you need to find your “enough”, and then hold yourself to it. Instead of using the inflated “enough” that the Joneses next door use, you’ve got to take a good look at your finances and find your own “enough”. Now, a show of hands, how many of you have actually found what enough means to you, and held to it?

I can’t actually see your hands, so maybe a show of hands wasn’t the right way to measure the tally. But, I’d bet that only a few of you actually would have put your hands up. Why? Because, you struggle with enough. I do too. Enough is an arbitrary measurement. What you think enough is today isn’t necessarily going to be enough tomorrow. So many factors go into what we believe enough is, and many of them change regularly.

A few years ago, if you’d have asked me what enough was, I would have told you that it was having a good paying job, a nice house with room for my family, and enough leisure time to enjoy the benefits of having those things. Today, my answer is a bit different. I quit my job a few months ago, and have had no other income besides what a part-time job and a handful of small sites provides. We still have my wife’s income, but, compared to what we were making before, it’s a fraction of what it was. Today, enough has a totally different feel to it. And, we struggle with it. Just like I’m betting you do to.

The struggle is rooted deep into our psyches. Growing up, we’re inundated with commercials touting the latest and greatest toys. As adults, the only difference is the price of the toys. Instead of a “Castle Grayskull Playset“, we want to have the newest credit card with all the fancy bonus miles, the new car with the rearview camera, or the house with the dedicated room for a library or mancave. And that doesn’t even begin to touch the use of money as a security device.

People fear being broke. A quick reminder that the name of this site is Beating Broke, will tell you that even I am not immune to the fear of being broke. I’ve got a small secret to let you in on though. Like “enough”, how you define “broke” makes all the difference in the world. For some, being broke means making less than $100,000 a year. If that’s the case, my family is way beyond broke. Even when I still had my job, we were a full-time income away from making $100,000 a year.

What does broke really mean to you? To me, broke is a place where you have tons of debt, and your income is the only thing keeping you afloat. You’re stuck in a job you don’t like, so that you can make money to pay your bills. The funny thing is, I feel less broke now that I don’t have a full-time job, than I did when I had my job. Part of that may be straight up delusion, but it’s true. But, I think a good part of that also comes from changing my definition of enough. Instead of the good paying job, nice house, and leisure time, my definition of enough is something that feels a little bit more like satisfaction. I’m satisfied with just barely making enough to pay the bills. I’m satisfied with finding free or low cost activities that will entertain us.

And yet, we struggle with it. For the last few weeks, I’ve been struggling with the idea of getting a new full time job. Partially because the income from this and other sites hasn’t scaled to the degree that I thought it might. Partially because with the amount that I’m making we teeter on that precipice of being able to adequately pay our bills. And, partially, because we still struggle with the definition of what enough is.

What is your definition of enough? How has it changed over the years, and do you feel that your definition of enough is enough?

Shane Ede is a business teacher and personal finance blogger. He holds dual Bachelors degrees in education and computer sciences, as well as a Masters Degree in educational technology. Shane is passionate about personal finance, literacy and helping others master their money. When he isn’t enjoying live music, Shane likes spending time with family, barbeque and meteorology.