There are several reasons that we own a home. One of the biggest is cost. Our mortgage, taxes, PMI, and insurance all come to only about $500 a month. To rent a home of equal size, in our area, would cost at least $650, if not more. It’s more cost effective for us to own, if you only take that into account. There are added costs to owning a home. Repairs and maintenance are an added cost that is unavoidable, but I look at it as another investment into the place I live. And, many of the improvements that we’ve done (see kitchen for instance) would have never been done had the house been a rental, and they’ve greatly improved the livability of the house. When it comes down to it, buying a home just makes sense.

I can clearly see the argument, in some parts of the country (and world) for renting over buying. I can also see situations where renting is just the smarter thing to do. But, for most, I just don’t see how it can work out in your favor. Why put money into someone elses pockets, when you could be putting it into yours? Even if your house doesn’t appreciate in value at all (or, even depreciates) you’ll still be left with something of some value when you’re done with it. Over those same 15-30 years of renting, what will you have? Nothing but a good renter history.

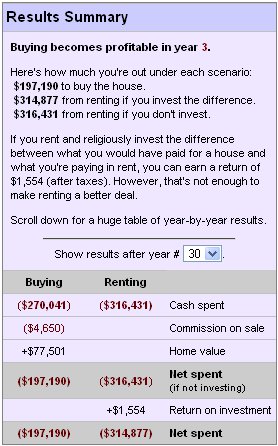

The mathematics of the rent vs. buying can get a bit complicated when people start talking about lost gains on investments and throw in interest, appreciation/depreciation, and the like. I found this cool calculator that does most of that for you. Hit the deluxe tab to really throw in a ton of variables. If you’re a homeowner, punch in your numbers and see if it is worth it for you to buy or to rent. I put our numbers in (that’s them in the picture), and, as I suspected, it’s better for us to buy vs. rent. I have played a bit with it, and I think it’s a bit skewed towards buying vs renting, but not so much so that it makes it not fairly accurate.

I think another good thing that the calculator does, is give you a better idea of what the different variables can do to the situation. Try playing with the appreciation numbers, or the return on investment number, or the length of mortgage, and see what that does to your situation.

Where are you on the rent vs. buy spectrum? Do you own? Why, or, why not?

Shane Ede is a business teacher and personal finance blogger. He holds dual Bachelors degrees in education and computer sciences, as well as a Masters Degree in educational technology. Shane is passionate about personal finance, literacy and helping others master their money. When he isn’t enjoying live music, Shane likes spending time with family, barbeque and meteorology.