Some people suffer from a certain form of optimistic financial denial. They look at part of someone else’s circumstances and use that to justify their own way of life, without considering the entire picture. Take, for example, a relative I have that I will call Stacey (not her real name). Stacey is nearing retirement, and she doesn’t have quite as much socked away for retirement as she would like because finances were very tight when she was young and she and her husband just didn’t have the extra to put away. Her husband died young, and she entered the full-time work force in her early 40s, which is when she began putting away for retirement in earnest.

Stacey isn’t one to worry. She tells herself that she should be able to get by just fine with the money she will have in retirement and uses the rationale first, that you never know how long you will live, and second, that her parents did just fine on a limited retirement. She is firm about retiring at 62 and cannot be persuaded otherwise; she is not interested in working part-time early in her retirement.

Stacey isn’t one to worry. She tells herself that she should be able to get by just fine with the money she will have in retirement and uses the rationale first, that you never know how long you will live, and second, that her parents did just fine on a limited retirement. She is firm about retiring at 62 and cannot be persuaded otherwise; she is not interested in working part-time early in her retirement.

Regarding Stacey’s first point, it is true that you never know how long you will live. I have, unfortunately, known plenty of people who retired and died within a year or two. Others died before they were even able to retire. However, Stacey’s parents lived to be 88 and 90, respectively, so if she takes care of herself, there is a good chance she will live well into old age.

Second, her parents did retire on a relatively small retirement savings, but they made some serious adjustments to their lifestyle. Here are some of the smart financial moves they made to make sure their retirement nest egg stretched:

- they immediately sold their paid for house, freeing themselves from the expense of upkeep, property taxes, and heating and cooling a large home

- they took some of the money from the house to buy a fifth wheel trailer, and they lived there during the summer months on their children’s property

- they took some of the money and bought a trailer in a retirement trailer park in Florida. They were then only responsible for monthly trailer park fees and heating and cooling

- they took the rest of the money and invested it

- they only went out to eat occasionally, usually when their children were visiting them in Florida

- they sent each of their 38 grandchild a crisp dollar bill for their birthday and at Christmas

On the other hand, here is where Stacey is:

- she still owes $70,000 on her 1,600 square foot home

- she has no immediate plans to sell, which means she is paying thousands of dollars a year on property tax, maintenance, and heating and cooling costs

- she goes out to eat several times a week and plans to continue doing so when she retires as that is her main way to socialize

- she only has 3 grand-kids, but she spends $100 to $125 per child per year for Christmas and birthday presents

- she would like to travel, including traveling internationally, when she retires

While Stacey is right that her parents did not have a large, comfortable retirement, she is only looking at part of their financial picture. Her parents were willing to make significant changes to downsize their expenses so they could live comfortably on the retirement they did have. In fact, when her last parent died at 90, there was still enough left over to give a small inheritance to each of their 9 children. To have a comfortable retirement of her own, Stacey should also downsize her lifestyle. It is the only way to make the money stretch as her parents did.

When it comes to your own retirement, or financial planning in general, it does little good to compare your finances to others. Ultimately, it can lead to a form of optimistic denial that can lead to considerable financial stress in the future.

Do you know anyone who suffers from financial optimistic denial?

Melissa is a writer and virtual assistant. She earned her Master’s from Southern Illinois University, and her Bachelor’s in English from the University of Michigan. When she’s not working, you can find her homeschooling her kids, reading a good book, or cooking. She resides in New York, where she loves the natural beauty of the area.

I have encountered some people who are optimistic like this. It’s kind of sad that they just trust things will “worth themselves out” without much planning.

But, in the end, things do have a habit of working themselves out and people end up doing what they NEED to do to make it work. Unfortunately, that usually means that some of the things they WANT to do will never be realized.

I suffer from a little bit of this over optimism, but I’m realistic to know that I probably will have to work up to 65-70 AND make life style adjustments so I don’t owe any debt at all. Is she an Aries? Aries seem to think their money problems will all work themselves out on their own. 😉

I suffer a bit from over optimism too. I’m sure Stacey will adjust her lifestyle once she figures out her saving won’t last. If she wants to go out a few times a week, then maybe she’ll change her mind about a part time job.

Although I am an optimistic person, I am a realist when it comes to retirement. I planned on living 25 years in retirement and I am starting at 70 years old. Part of my plan is to have no debt and have sufficient savings to travel and enjoy life. I keep a low profile lifestyle which allows me to max out my savings.

Uh-oh. Stacey is going to have a rude awakening if she keeps going down this path. I can only hope that she takes some personal responsibility for the situations and acknowledges her mistakes so she can correct them.

I bet she ends up with at least a part time job.

I think there’s something to be said for being optimistic. Heck, I’m optimistic. But, then there’s being blindly optimistic. Pretending that the problem doesn’t exist falls into that category. I also wonder if some of those who are blindly optimistic aren’t really all that blind to the problem, they just choose to ignore it.

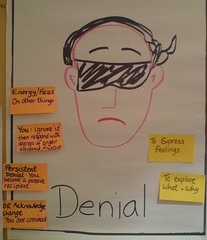

Oh, yes. I meet people like Stacey all the time. I call it financial teenager syndrome – we act like teenagers who believe nothing bad can happen to us. Which leads to the state of denial as we get older because we don’t want to admit things aren’t the way they should be. Then we get creative with our excuses because we’d rather keep making the lies bigger instead of facing the truth.