There are several reasons that we own a home. One of the biggest is cost. Our mortgage, taxes, PMI, and insurance all come to only about $500 a month. To rent a home of equal size, in our area, would cost at least $650, if not more. It’s more cost effective for us to own, if you only take that into account. There are added costs to owning a home. Repairs and maintenance are an added cost that is unavoidable, but I look at it as another investment into the place I live. And, many of the improvements that we’ve done (see kitchen for instance) would have never been done had the house been a rental, and they’ve greatly improved the livability of the house. When it comes down to it, buying a home just makes sense.

I can clearly see the argument, in some parts of the country (and world) for renting over buying. I can also see situations where renting is just the smarter thing to do. But, for most, I just don’t see how it can work out in your favor. Why put money into someone elses pockets, when you could be putting it into yours? Even if your house doesn’t appreciate in value at all (or, even depreciates) you’ll still be left with something of some value when you’re done with it. Over those same 15-30 years of renting, what will you have? Nothing but a good renter history.

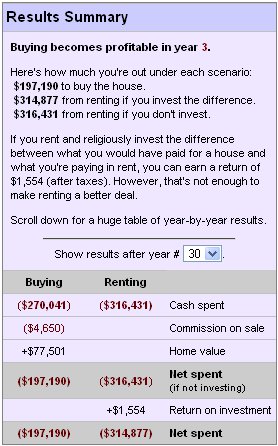

The mathematics of the rent vs. buying can get a bit complicated when people start talking about lost gains on investments and throw in interest, appreciation/depreciation, and the like. I found this cool calculator that does most of that for you. Hit the deluxe tab to really throw in a ton of variables. If you’re a homeowner, punch in your numbers and see if it is worth it for you to buy or to rent. I put our numbers in (that’s them in the picture), and, as I suspected, it’s better for us to buy vs. rent. I have played a bit with it, and I think it’s a bit skewed towards buying vs renting, but not so much so that it makes it not fairly accurate.

I think another good thing that the calculator does, is give you a better idea of what the different variables can do to the situation. Try playing with the appreciation numbers, or the return on investment number, or the length of mortgage, and see what that does to your situation.

Where are you on the rent vs. buy spectrum? Do you own? Why, or, why not?

Shane Ede is a business teacher and personal finance blogger. He holds dual Bachelors degrees in education and computer sciences, as well as a Masters Degree in educational technology. Shane is passionate about personal finance, literacy and helping others master their money. When he isn’t enjoying live music, Shane likes spending time with family, barbeque and meteorology.

I’m looking to own in the end. I would preferably like to live at home with my parents until I can put a sizeable down payment on a house. If I rent I get nothing, if I buy I can atleast sell and recoup something. In the end it all depends on where you live and what level of flexibility you like.

-Ravi Gupta

BB,

Staying away from debt is my passion. So, we rent. I purposely live less than I can afford, so I can place the difference in a “House Account”. I will use that account in 30 years to buy a place outright. In the meantime, yes, I live in less than “I rate”, but it is ok to us, while we stay away from debt.

But it is not for everyone.

Keep up the good work,

Eric

I want to own a home, and I do. Like Eric mentioned, being this much in debt does have its downsides, but I am happy to be paying a “rent” to something tangible, and not giving it away. Plus, for my home, my mortgage and total cost is less than what rent would be in my neighborhood.

Right now I have the best of both worlds. 🙂 I signed a lease-to-own agreement with a private owner. I have a 10 year (yes, you read that right) agreement that is renewable every 12 months. At the end of 10 years I have the option to apply 35% of everything I’ve paid to a downpayment (assuming I can get financing) and buy the house outright, or I can continue to lease. As of right now I’m on track to buy.

I think that the rent vs. buy argument depends on a lot of things: where you are in your life, what your goals are, and so forth. When I was younger I wanted nothing more than the freedom to pick up and move when and where I wanted and renting made sense. Now that I’m more settled and building a business, I know that I’m going to want to stay here for many years. In that situation it makes sense for me to buy or plan to buy.

But as with all parts of PF .. the PERSONAL part really comes into play. Neither renting nor buying is better than the other … it’s all about what works for the individual.

There is a very important piece of information you didn’t mention. Rent goes up, mortgages don’t.

If you are renting, over the years, your rent will creep up. If you’re paying $650 today, in ten years, you could be paying close to $1,000 for a similar space (or even the same space.)

On the other hand, if you have a mortgage payment of $650 now, in ten years, your mortgage payment will still be $650. In twenty years, it will be $650.

Renting is never the smartest financial move. Sometimes its preferable for other reasons, especially when you’re young and your life is still in flux.

Renting is definitly right if your young and short on capital. However, there comes a point where you have to buy and it seems like the right time. Real estate is as low as it could get, and buyers are getting deals.

Hi BB,

I tend to be on the renting side of the equation, unless the home is purchased with a 15 year or less, fixed rate mortgage. It would be a shame to have paid 15 years into a house and find that you still have 15 years remaining after so many payments shelled out. I say get it over with and build equity faster, both at the same time.

Romeo

We own are home outright. No mortgage, in fact we have no debt what so ever. I know a lot of financial advisers say to take the mortgage and invest the difference. For us, it is about a lifestyle choice. With no payments, we have choices and that is what is important to us.

With home values still dropping and no end in sight it might be a good time to rent right now.

I am on the owning side of the equation. Even with a 30 yr mortgage, I could easily live for another 20 years after it is paid off and then not have rent. Plus, my kids would have some equity. My parents bought a house in the 1970’s and lived there until downsizing into a condo. The house was paid off and when sold, the cash was used to pay for the condo plus have some left over.

Before committing to buy you definitely have to figure out how long you are going to be in that location. It can be difficult to know, but if you don’t think you’ll be in the home for at least 5 years I don’t think it’s worth the time and money to buy.