Let’s face it—despite our increasingly digital world, there’s something incredibly satisfying about handling physical cash when you’re trying to stick to a budget. If you’re among the growing number of people returning to cash spending for better financial control, you’ve probably heard about the envelope method. It’s simple but effective: divide your cash into different envelopes for various expenses, and when an envelope is empty, that’s it until the next payday! I’ve tested dozens of cash envelope systems, and here are the best options I’ve found for anyone serious about getting their spending under control.

1. The Savvycents Cash Budgeting Wallet

The Savvycents Cash Budgeting Wallet feels like it was designed by someone who truly understands the struggles of sticking to a budget. Made from soft but durable leather that actually improves with age, this wallet won’t embarrass you when you pull it out at dinner or the store. The thoughtful touches really show that the company gets it, like the accordion-style filing system inside and the simple zip-around enclosures. Each envelope comes with a handy label to organize your spending. Honestly, there’s something motivating about having such a beautiful tool for something as mundane as budgeting.

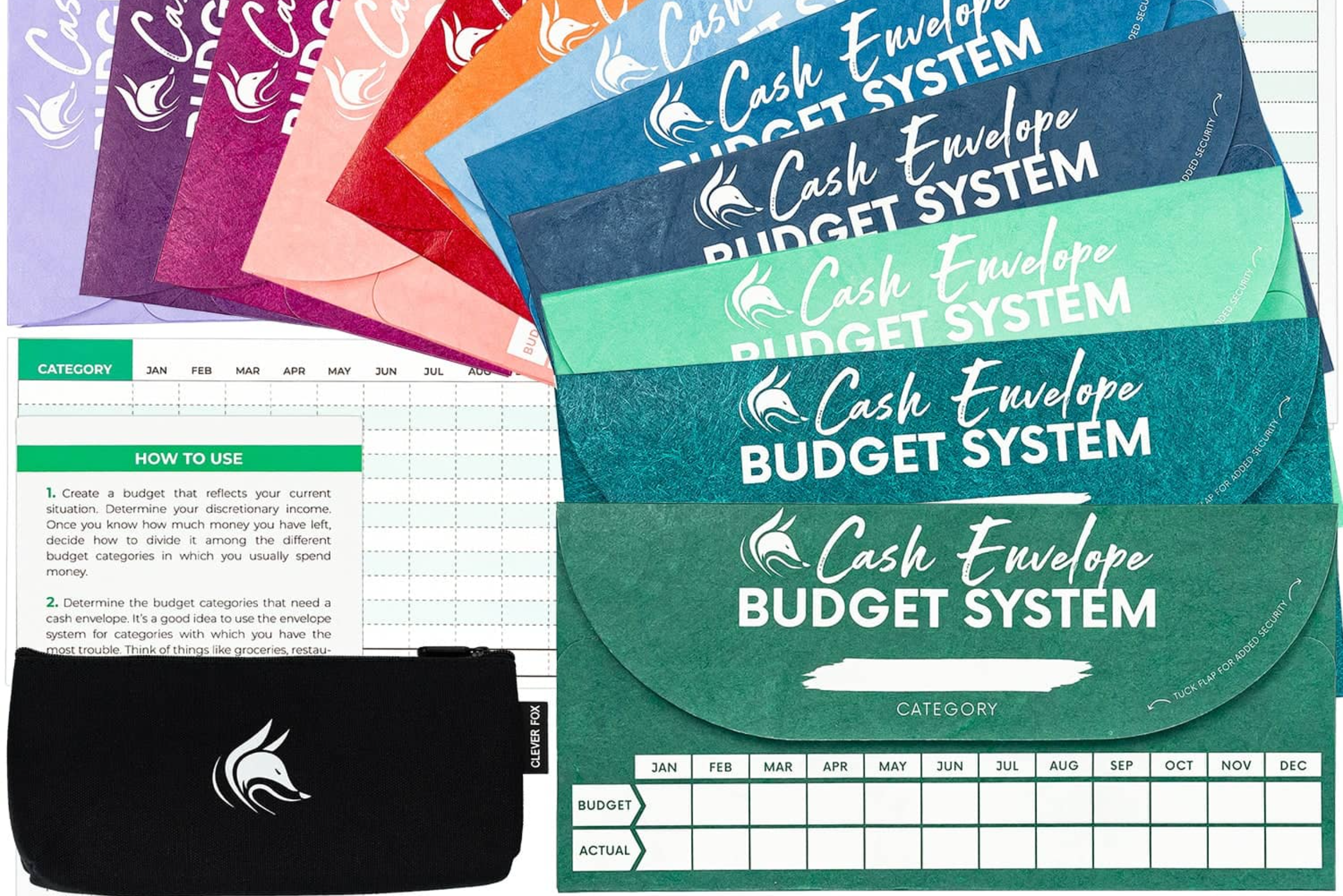

2. Clever Fox Cash Envelope Budgeting System

Listen, I was skeptical about spending less than $20 on a budgeting system—usually, you get what you pay for, right? But the Clever Fox envelopes completely changed the game. These things are practically indestructible! They can survive coffee spills or getting crushed at the bottom of an overstuffed bag. Having 12 different colored envelopes might seem like overkill until you realize how satisfying it is to have a dedicated purple envelope just for your coffee habit or a bright yellow one for spontaneous fun money. The best part? Writing directly on the envelopes to track spending.

3. Dave Ramsey’s Cash Envelope Wallet

When Dave Ramsey, the godfather of strict budgeting, produces a cash wallet, you take heed. The genius of this wallet is that it eliminates every excuse for not sticking with cash budgeting. “It’s too complicated to carry separate envelopes.” Nope—it’s all in one place. “I forgot my budgeting envelopes at home.” You can’t use that one either—this IS my wallet now. “I need somewhere for my cards too.” It’s got slots for those. The simple design feels pleasantly old-school in the best way, like I’m the CEO of my own personal finances. Yes, it bulks up when every envelope is stuffed after payday (I’ve gotten some looks when I plop this beast on the counter), but watching those envelopes gradually thin out gives a visual progress report each month. If you’re serious about making cash budgeting stick long-term, this system removes literally every barrier except your own willpower.

4. Rnairni Cash Envelope Wallet

Anyone who’s tried juggling loose envelopes knows the frustration of leaving the right one at home exactly when you need it. The Rnairni Cash Envelope Wallet solves this problem brilliantly by creating an all-in-one command center for cash budgeting. This wallet comes with everything needed to start budgeting immediately—12 laminated cash envelopes that won’t tear after a few uses, budget sheets to track spending, and even a quick-start guide for budgeting newcomers. The thoughtful extras make this wallet stand out from basic envelopes: RFID-blocking technology protects credit cards from digital theft, while the spacious design accommodates smartphones, passports, and checkbooks. The removable wrist strap is particularly clever for shopping trips when hands need to be free to pick up items or manage children.

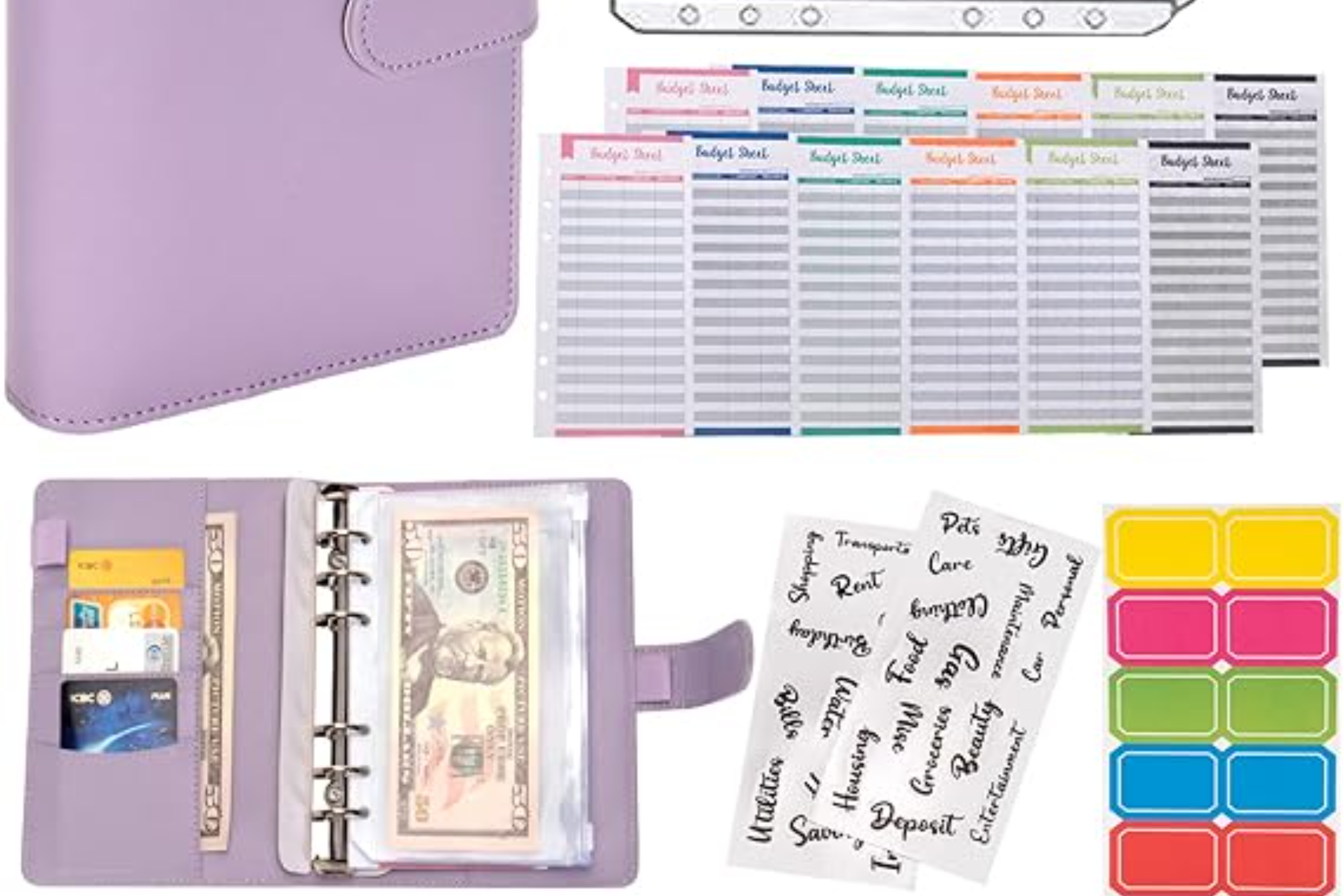

5. Budget Binder Cash Envelopes

Budget-conscious shoppers looking for maximum value will appreciate the Budget Binder Cash Envelope System. At just $8, this wallet delivers impressive functionality without breaking the bank. The clever ring binder design securely holds 12 laminated cash envelopes, making it easy to add, remove, or reorganize categories as budgeting needs change. The complete budgeting kit includes everything needed to start managing money more effectively right away—12 budget tracking sheets complement the envelopes, creating a systematic approach to monitoring expenses. While it doesn’t offer extras like smartphone storage or RFID protection found in more expensive models, its focused design excels at its primary purpose: organizing cash into categories that prevent overspending.

Choosing the Right Budgeting Envelope System

Finding your perfect cash envelope system isn’t just about picking the prettiest option—it’s about knowing yourself and your habits. Are you the person who needs the visual reminder of transparent pouches, or do you prefer the privacy of opaque envelopes? Do you need something that fits in a pocket, or are you always carrying a bag? Consider how many spending categories you realistically need to track—too many can become overwhelming and defeat the purpose of simplifying your finances.