Smartphones are amazing devices that can do so much more than just make calls and send messages. They are also packed with hidden features that can make your life easier, more productive, and more fun. Here are 15 of them that you might not know about.

1. Scan QR Codes Without An App

QR codes are everywhere these days, from product labels to restaurant menus. They can contain useful information, such as links, coupons, or contact details. But did you know that you don’t need a separate app to scan them? You can just use your smartphone’s camera app. Simply point your camera at the QR code and tap on the notification that pops up. You will be taken to the relevant website or app.

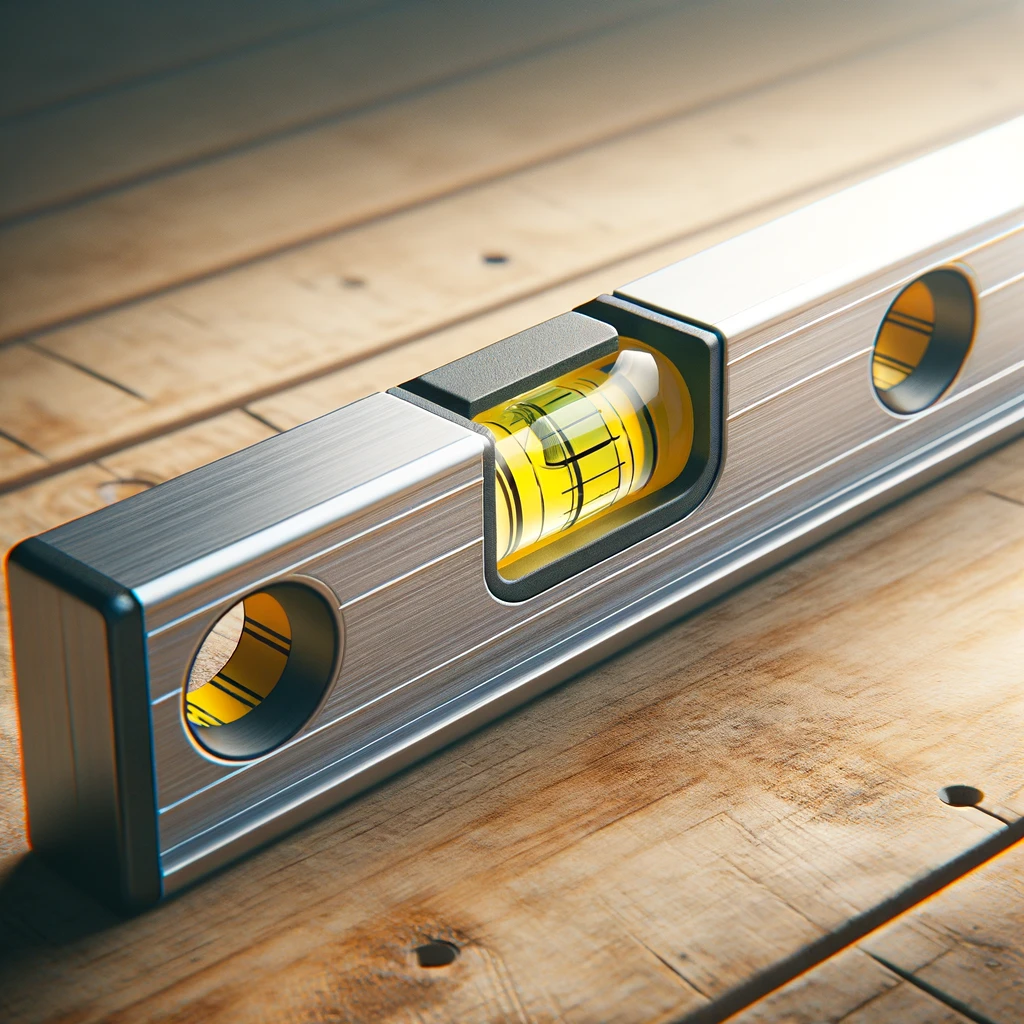

2. Use Your Phone As A Level

If you need to hang a picture or a shelf, you can use your phone as a handy level tool. Just open the Compass app on your iPhone or the Measure app on your Android phone and swipe left. You will see a level indicator that shows you how much your phone is tilted. You can also calibrate it by placing it on a flat surface and tapping the screen.

3. Turn Your Phone Into A Magnifying Glass

Sometimes you need to zoom in on something small, such as a fine print or a tiny detail. You can use your phone’s camera to do that, but there is a better way. You can turn your phone into a magnifying glass by enabling the Magnifier feature in the Accessibility settings. This will let you use your phone’s volume buttons to zoom in and out, and also adjust the brightness and contrast of the image.

4. Control Your Phone With Voice

You can use voice commands to control your phone without touching it. For example, you can say “Hey Siri” or “OK Google” to activate your virtual assistant and ask it to do things like set reminders, play music, or make calls. You can also use voice commands to perform specific actions on your phone, such as taking screenshots, opening apps, or adjusting settings. To enable this feature, go to the Voice Control settings on your iPhone or the Voice Access settings on your Android phone.

5. Use Your Phone As A Remote Control

You can use your phone as a remote control for various devices, such as smart TVs, streaming boxes, or game consoles. All you need is an app that supports the device you want to control. For example, you can use the Apple TV Remote app on your iPhone or the Android TV Remote Control app on your Android phone to control your smart TV. You can also use apps like Roku, Chromecast, or Xbox to control other devices.

6. Split Your Screen For Multitasking

You can split your screen into two windows and use two apps at the same time on your smartphone. This is useful for multitasking, such as watching a video while browsing the web, or checking your email while using a calculator. To do this, open one app and then swipe up from the bottom of the screen and hold until you see the app switcher. Then drag the app you want to split to the top or left of the screen and release it. Then tap on another app to open it in the other half of the screen.

7. Translate Text In Real Time

You can use your phone’s camera to translate text in real time, such as signs, menus, or labels. This is handy when you are traveling or learning a new language. To do this, open the Google Translate app on your phone and tap on the Camera icon. Then point your camera at the text you want to translate and select the language you want to translate from and to. You will see the translated text overlayed on the original text.

8. Use Dark Mode For Better Battery Life

Dark mode is a feature that changes the color scheme of your phone’s interface from light to dark. This can make your phone easier on the eyes, especially at night or in low-light conditions. But did you know that dark mode can also save battery life? This is because dark mode reduces the amount of light emitted by your screen, which consumes less power. To enable dark mode, go to the Display settings on your phone and toggle on Dark Mode.

9. Unlock Hidden Games

Your smartphone has some hidden games that you can play for fun when you are bored or need a break. For example, you can play a dinosaur game on Chrome when you are offline by tapping on the dinosaur icon and then tapping anywhere on the screen to make it jump over obstacles. You can also play a snake game on Google Maps by swiping left from the menu and tapping on Play Snake.

10. Use Gestures For Faster Navigation

You can use gestures instead of buttons to navigate your phone faster and easier. For example, you can swipe up from the bottom of the screen to go to the home screen, swipe left or right from the edge of the screen to go back or forward, or swipe down from the top of the screen to access the notification panel. To enable gestures, go to the Navigation settings on your phone and choose Gesture Navigation.

11. Scan Documents With Your Phone

You can use your phone’s camera to scan documents, such as receipts, invoices, or contracts. This can save you time and hassle, as you don’t need a scanner or a printer. You can also edit, sign, or share the scanned documents with ease. To do this, open the Notes app on your iPhone or the Google Drive app on your Android phone and tap on the Camera icon. Then choose Scan Documents and take a picture of the document you want to scan.

12. Use Your Phone As A Flashlight

You can use your phone’s flash as a flashlight when you need some extra light, such as in the dark or in an emergency. To do this, swipe down from the top of the screen and tap on the Flashlight icon. You can also adjust the brightness of the flashlight by using the slider that appears. To turn off the flashlight, tap on the icon again.

13. Use Your Phone As A Hotspot

You can use your phone’s cellular data to create a hotspot that you can share with other devices, such as laptops, tablets, or other phones. This can be useful when you don’t have access to Wi-Fi or when you want to save money on data plans.

Go to the Personal Hotspot settings on your iPhone or the Mobile Hotspot settings on your Android phone and toggle on Personal Hotspot or Mobile Hotspot. Then choose a password and a network name for your hotspot and connect your other devices to it.

14. Use Your Phone As A Ruler

You can use your phone’s screen as a ruler to measure small objects, such as coins, keys, or jewelry. Use the feature by opening the Measure app on your iPhone or download a ruler app on your Android phone and place the object on your screen. Then use your finger to drag the measurement tool over the object and see its length in inches or centimeters.

15. Use Your Phone As A Mirror

You can use your phone’s front camera as a mirror when you need to check your appearance, such as before a meeting, a date, or an interview. To use this feature, open the Camera app on your phone and switch to the front camera by tapping on the camera icon. Then adjust the angle and lighting of your phone and see yourself on the screen.

Make Life Easier

These are some of the hidden features in your smartphone that will make your life easier. Try them out and see how they work for you. And don’t forget to share this article with your friends and family who might find it useful too!