Did you know that when you were born, the only things you were afraid of were loud noises and falling? It’s true. Anything else is a learned fear. Now, it may be true that you can learn a fear at a young enough age that you won’t actually remember where the fear originates, but it’s still a learned fear.

Stop and think about that for a minute. What are some of your fears? Each and every one of them is a learned fear. And if something is learned, it can be unlearned. Or, at least corrected with proper learned knowledge. Take today for instance. It’s Friday the 13th. Well known as the day of bad luck. Walking under a ladder today, or breaking a mirror today is double bad luck. Isn’t it? Well, it’s something like that, I’m sure.

Superstitions and fear have done their fair share of damage throughout the years. The first good example that comes to mind would be the Salem witch trials. All those innocent women burned at the stake. It’s especially heinous when, after watching The Wizard of Oz, everyone knows that you pour water on a witch if you want to get rid of them. Less mess too.

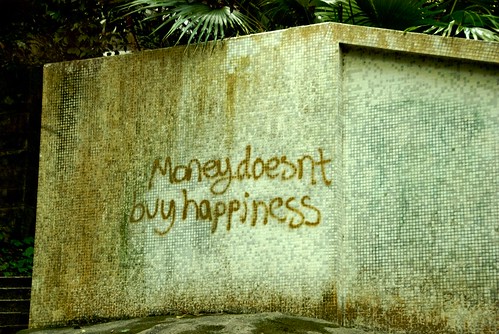

Seriously, though. Your superstitions about money, and fears about money are learned. Somewhere along the way, you decided that the superstition or fear was a valid one to have. Money superstitions are just as much hocus pocus as crazy Quaker witches. Today, Friday the 13th of July, 2012, take a few moments to really think about the superstitions and fears that you apply to your money. Then, do something small that goes against those fears.

Have a fear of losing it all? Take a handful of change down to the river or lake and toss it in. It’s not everything. Just some random bits of metal in a circular shape. Not only can you make more, but you’ll likely get along just fine without it.

What are your money fears and money superstitions? Share them below, and let’s all compare and see how common some of them are?

And remember, there are babies all around the world being born today that have none of them, until we teach them to them.

Shane Ede is a business teacher and personal finance blogger. He holds dual Bachelors degrees in education and computer sciences, as well as a Masters Degree in educational technology. Shane is passionate about personal finance, literacy and helping others master their money. When he isn’t enjoying live music, Shane likes spending time with family, barbeque and meteorology.