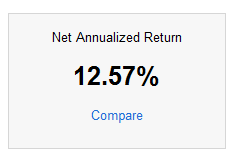

As I mentioned in my last post, I’ve been taking 10% of my income from my online ventures and splitting it between my Lending Club account and my Sharebuilder account. It’s been a bit of an experiment. Nothing scientific, but a test to see if I drop the same amount of money into each account, what the returns and stability would look like. My returns on Lending Club have been very good, and the stability has been good so far. Let’s take a look at the Sharebuilder account.

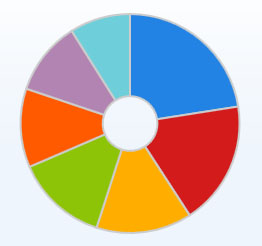

So far, I’ve got about $264 put into the account. (Yep, I’m a heavy hitter. 🙂 ) So far, I’ve got six investments that I’ve split the money between. There’s also about $50 that is in cash at the moment.

- ARCC

- CIM

- LTC

- MAIN

- NRGY

- TICC

If you’re like me, you’ve likely never heard of any of those. You’re probably more familiar with symbols like WMT, MSFT, APPL, or C. One thing they have in common, is that they’re all dividend paying stocks. I like that. As time goes on, I’ll be balancing out these lesser known stocks with some other, more familiar dividend paying stocks. For now, that’s what the portfolio looks like. They’re all pretty evenly split as far as portion of portfolio invested. So far, the only one that is in the green is MAIN, and just barely.

Currently, my Sharebuilder account is showing a -13.30% return.

The Sharebuilder account is getting a bit of a bad rap here. Part of the reason that the return is so abysmal is that I’ve got a $260 portfolio split up into 6 stocks. Each purchase comes with a $4 fee. So, right away, the investments have to overcome a $24 loss. Take that $24 out of the equation, and the account is only down a few bucks, and the return, while still negative, is far less so. That also brings us to the cash that’s sitting in the account. Previously, I would make a purchase when the balance got over $34, so that, once the $4 fee was taken, I was still buying $30 worth of the stock. After seeing what that was doing to the results, I’ve changed that, and will likely start making purchases in $50-$60 lots. It will take longer to build the portfolio, but the impact of the fee will be lessened.

Overall, there really isn’t much comparison of the returns between the Lending Club and Sharebuilder accounts. Taken on their face, Lending Club wins hands down. I have to add, however, that the investments available in the two are very different. For the most part, you won’t lose an investment in Sharebuilder. Unless you invest in the next Enron, that is. With Lending Club, the risk is higher, because a borrower could default on the loan and you could lose all of that money if they do. But, there’s an obvious trade-off here. For the higher returns of Lending Club, you have higher risk. Less risk, with Sharebuilder, gets you less returns. Simple as that. I’ll likely continue doing both, for a while and see what the 1 year comparison looks like in July.

Have you ever used Sharebuilder? Where do you put your investments? Do you have a “fun” account like my Sharebuilder account?

I started this blog to share what I know and what I was learning about personal finance. Along the way I’ve met and found many blogging friends. Please feel free to connect with me on the Beating Broke accounts: Twitter and Facebook.

You can also connect with me personally at Novelnaut, Thatedeguy, Shane Ede, and my personal Twitter.