I recently had a small discussion on Facebook with Glen, of Free From Broke. It started when he mentioned in his status that he had been at the doctors office waiting on his appointment for 44 minutes. He asked if he should just say to heck with it and reschedule the appointment. I suggested that he wait it out, then send the doctor a bill for his time spent waiting. Most people, when I make a similar suggestion, think that I’m joking. That’s only half true. I honestly think that if you’re waiting for a long enough time, you ought to send a bill. I’m not the only one, either. Check out this article, and this one on CNN.

Now, I’ll be completely honest. I’ve spent plenty of time waiting on doctors, dentists, and the DMV. I’ve never once sent a bill. I’m chicken. 🙂 Really, I think that we’re preconditioned to expect that we’ll wait for a doctor, and since we’re paying them for the service, and we need the service, we don’t dare rock the boat. But, there’s a couple of good arguments against that being true. The biggest of which is that capitalism requires participation.

An economic system characterized by private or corporate ownership of capital goods, by investments that are determined by private decision, and by prices, production, and the distribution of goods that are determined mainly by competition in a free market.

Capitalism and the Free Market

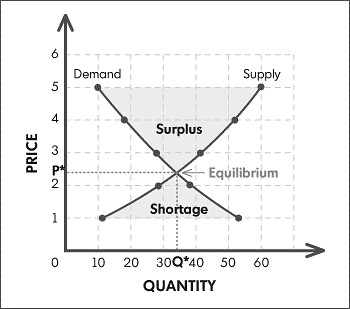

In particular, I’d like to point out the last part of that. “determined mainly by competition in a free market”. What drives that competition, and as a result, the free market? The law of supply and demand. In the law of supply and demand, the prices of goods and services are determined by the supply that exists for a good or service, and the demand that exists for that same good or service. If demand is high for something, and the supply is low, or limited, the people who have the supply can charge more because the ratio of supply to demand is higher. But, what about something like a doctors visit? Doctors aren’t exactly in a low enough supply to warrant higher prices. While our insurance companies are able to negotiate cheaper prices for services with a doctor, we very rarely will even ask if there’s a better rate. And, we’ll willingly sit in a waiting room for extended periods of time, which, anyone familiar with the concept of time cost will tell you, costs money.

In particular, I’d like to point out the last part of that. “determined mainly by competition in a free market”. What drives that competition, and as a result, the free market? The law of supply and demand. In the law of supply and demand, the prices of goods and services are determined by the supply that exists for a good or service, and the demand that exists for that same good or service. If demand is high for something, and the supply is low, or limited, the people who have the supply can charge more because the ratio of supply to demand is higher. But, what about something like a doctors visit? Doctors aren’t exactly in a low enough supply to warrant higher prices. While our insurance companies are able to negotiate cheaper prices for services with a doctor, we very rarely will even ask if there’s a better rate. And, we’ll willingly sit in a waiting room for extended periods of time, which, anyone familiar with the concept of time cost will tell you, costs money.

Participating in Capitalism

In order to change that status quo, we need to start participating in our capitalism. The clinics and hospitals that many of the doctors work at are requiring their doctors to schedule appointments in 15 minute or 30 minute increments. How many times have you gone to the doctor and spent more time than that in the exam room? I know I probably do at least every other time. Obviously, that’s not a very efficient way to schedule the time. But, they do it so that the doctors can squeeze in as many patients as possible. It’s ruled by profit. The more patients a doctor sees in an hour, the higher the profit is for the clinic. They’ll never change that unless the profit starts to go away. How does the profit go away? Well, either the doctors become so expensive that they’d have to see many more patients in a day than physically possible (they’d just raise rates), or they start getting bills for the patient time they are wasting.

If patients begin billing for the time they spend in a waiting room, eventually, it becomes more expensive to keep patients waiting than it does to change the way they schedule appointments. Consider the last time you had cable hooked up in your home. You likely called the cable company to set up an appointment, and they gave you a 4-5 hour window when the technician would be there. What if you then told them that your time is valuable to you, and that they can expect a bill for every half hour past the beginning of that window that you’re kept waiting on the technician? Do you think he’d make you wait the full 5 hours? Not very likely.

The prices of goods and services, including the time those services take to perform, are determined by what the market will bear. As long as the market continues to pay the cost of the goods or services, the provider can continue to charge that price. Sometimes they’ll start increasing it. But, when we begin to value our time, and hold service providers accountable for the cost of time wasted waiting on them to perform a service, we can begin to tell those providers that the market will no longer bear the cost of lost time. In short, we begin to participate in the free market economy we call capitalism.

Would you ever bill a service provider, doctor or otherwise, for time spent waiting on them? If not, is it because you don’t value your time, or because you believe that the service provider is truly doing all they can to proved the best services? Is the service providers time more valuable than yours, and that’s why you won’t bill for your time?

img credit: mishra-ajay, on Flickr

Shane Ede is a business teacher and personal finance blogger. He holds dual Bachelors degrees in education and computer sciences, as well as a Masters Degree in educational technology. Shane is passionate about personal finance, literacy and helping others master their money. When he isn’t enjoying live music, Shane likes spending time with family, barbeque and meteorology.

Now, let me tell you something that will knock your socks off. At least, it will if you live in one of those bigger cities. Me and my family of 4 (+1 dog) do just fine on less than $70,000 a year. We’re not extremists, living in a small trailer in a campground somewhere, eating only rice and beans all the time either. Could we survive on less? I know we could. We have debt; student loans, car loans, medical bills, a mortgage, and your regular monthly utilities and such. But, the cost of living here makes it not only doable, but affordable to live on that amount.

Now, let me tell you something that will knock your socks off. At least, it will if you live in one of those bigger cities. Me and my family of 4 (+1 dog) do just fine on less than $70,000 a year. We’re not extremists, living in a small trailer in a campground somewhere, eating only rice and beans all the time either. Could we survive on less? I know we could. We have debt; student loans, car loans, medical bills, a mortgage, and your regular monthly utilities and such. But, the cost of living here makes it not only doable, but affordable to live on that amount.