I’ve always been a proponent of the buy and hold method of investing. If you’re unfamiliar with the concept, it’s basically the method of buying a stock (or bond, mutual fund, etc) and holding it forever. Well, maybe not quite forever, but certainly for as long as you don’t need any liquidity. For most, that’s pretty much right up until retirement.

I’ve been playing at investing for many years. Over a decade. To say that I’m successful would be stretching the truth just a bit. I remain a buy and hold method advocate however. Let me give you a couple of examples.

My investing history goes a bit further back than this example, but these are both examples from when I got a bit more serious about investing. But, also a time when I was still very new to real investing and learning the world of investing the hard way; by trial and error.

Let’s start with what could be one of the strongest reasons why you should do your research, pick a stock, buy it, then hold on to it.

In October of 2000, I bought 3.95 shares of stock in a company you might be familiar with. Apple Computers. (AAPL) For those 3.95 shares, I paid a grand total of $47.25 (including $5.98 in trading fees). The stock had recently split, so the price was down. As an IT professional (or at least a future one at the time), I was pretty familiar with Apple and thought well of the company. I bought the stock with the idea that it was a company that I liked, and wasn’t likely to disappear. That’s about the extent of the research I had done. Back then, I invested with a company called BuyandHold (define irony, eh?) but I mostly invest in stocks through Sharebuilder and Kapitall today.

Somewhere around April of 2001, I began thinking that I really should be buying stocks that paid a dividend if I wanted my portfolio to grow. Note: I still believe that the majority of your portfolio should be giving you income in the form of passive income (e.g. dividends). At the same time, the Apple stock that I had purchased not only didn’t pay any dividends, but it’s price per share really wasn’t going anywhere at all.

Of course, all of this was before the coming of the iPod, iPhone, and iPad. Those didn’t come around until a few years later. At the time, Apple was just a computer company that made some pretty cool machines, but not much else to speak of. On May 1st, 2001, I sold my entire position in Apple for a grand total of $47.25 (after $2.99 in trading fees). If you do the math (I have), I sold it for a profit… of $0.29. Yep. Not even thirty cents.

But, that’s not the lesson. Here’s the real lesson.

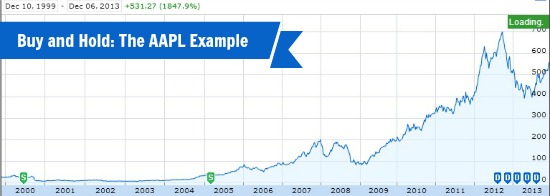

In 2005, riding the success of the iPod, iPod Shuffle, and iPod Mini, and the iPod Nano, the stock of Apple began to rise. And then they released the iPhone in 2008. And the iPad in 2010. And their stock has never looked back.

The Buy and Hold Lesson:

If I had held on to those 3.95 shares of AAPL, and reinvested the dividends that Apple began paying in 2012 (bringing the total to 3.978 shares), they would be worth $2227.83. The difference? $2180.58.

It’s no small amount. And a painful (to the wallet and ego) lesson.

Of course, hindsight is 20/20. There was no way, back in 2001, that I could have possibly foreseen the successes that Apple would have nearly 5 years later. But, if I had stuck to my buy and hold policy, and not worried about the details, I’d have a better looking portfolio now.

What about you? What stock did you sell that you shouldn’t have?

I started this blog to share what I know and what I was learning about personal finance. Along the way I’ve met and found many blogging friends. Please feel free to connect with me on the Beating Broke accounts: Twitter and Facebook.

You can also connect with me personally at Novelnaut, Thatedeguy, Shane Ede, and my personal Twitter.

I have a good story too. During the 2008 and 2009 era I had been interested in stocks and we’ll more into the penny stocks. I ran across YRCW a truck company about to go bankrupt. I had been following some people who were very high on it so I bought 300 shares for about $0.23 a share. Long story short I sold them a couple months later at like $0.30 a share but about 4 months ago they were trading at like $31.00. If only……