As I mentioned before, I’ve been taking the normal 10% contribution amount that most would be putting into their retirement accounts and splitting it between my lending club account, and a sharebuilder account. It’s been a bit of an experiment. I happen to think that lending club is a relatively safe investment option for a portion of your portfolio. I’ve still got my 401(k) from my old job, so the investments that I’ve made at lending club and in the sharebuilder account don’t even really make up 5% of my total investments. In short, I can afford to get a bit risky with the money. So far, it’s been anything but risky, however. I’ll update on the sharebuilder account in another post. Let’s take a look at what my lending club account has done.

To date, my investments look a little like this:

- Total loans invested in: 24

- Total loans paid off:5

- Total loans defaulted: 0

With only 24 loans, it could be that I’ve just been lucky thus far. I’ve had a couple of the loans go past due by 10-15 days, but nothing that hasn’t been caught up and made current. And no defaults. As I continue, I expect that I’ll see one or two. With all the doom and gloom about the economy recently, I fully expected to see one already.

With only 24 loans, it could be that I’ve just been lucky thus far. I’ve had a couple of the loans go past due by 10-15 days, but nothing that hasn’t been caught up and made current. And no defaults. As I continue, I expect that I’ll see one or two. With all the doom and gloom about the economy recently, I fully expected to see one already.

To date, I’ve deposited $257.20 into the account. That includes money from before this experiment started, so it’s not all recent. With that 257.20, I’ve invested in $511.36 in loans. The math savvy of you will notice that the invested amount is quite a bit more than the deposited amount. That just means that the money has turned over almost 100% since being invested. The more recent money, which accounts for about 50% of the account hasn’t had a chance to turn over yet, or that number might be higher. My total income, minus fees, is $36.26.

My portfolio breaks down like this:

- 39% of the loans are D grade

- 25% of the loans are B grade

- 15% of the loans are C grade

- 9% of the loans are F grade

- 7% of the loans are E grade

- 4% of the loans are A grade

As you can see, I’ve gone a bit riskier and weighted the portfolio towards the higher grades, but is still heavily centered around the C/C+ grade. (Read this to see how I select loans)That keeps my return a bit higher, while also keeping the risk a bit lower. Speaking of return, what is mine?

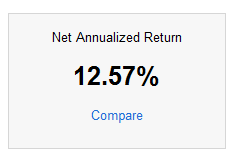

According to lending club, my net annualized return is 12.82%.

I like that. It’s far better than any bank or credit union is going to pay me for my money. To get that, I give up the liquidity of the money (I’d have to sell my notes to get the cash), and I give up some of the stability of the money (it’s riskier than a savings account or CD). Because this isn’t my emergency fund, or normal savings, I’m ok with giving up both of those things, in exchange for an above average return.

Do you invest with peer-to-peer lending? Do you use Prosper? Lending Club? Both? How’s your return?

Shane Ede is a business teacher and personal finance blogger. He holds dual Bachelors degrees in education and computer sciences, as well as a Masters Degree in educational technology. Shane is passionate about personal finance, literacy and helping others master their money. When he isn’t enjoying live music, Shane likes spending time with family, barbeque and meteorology.