Picking the best signal service provider in the Forex market is a very tough task. Some of you might not have any clear idea about the signal service providers. Those who sell trading signals to the retail traders in exchange for money are known as signal service providers. Usually, they are highly skilled professionals who know the perfect way to execute the trade. Being a currency trader, you might think using the trading signals from other people is nothing but waste of money. But if you can find the reliable signal service provider, you can actually make your life better. Let’s learn the technique by which we can pick the best signal service provider.

How to Stay Afloat after Losing Your Job

Losing your job is a really hard thing to face at any time, whether you saw it coming or not. You likely feel very overwhelmed with thoughts of how you are going to make rent next month or afford groceries next week. But it is important to keep a clear head and act fast to set yourself up for success as soon as possible so you can find new work.

Here are a few important steps that you should take within the first few days to week of your unemployment. They should help stabilize you and get you feeling sane enough to do what you need to do to find a new job.

- First Step: Apply for Unemployment

If you qualify for it, make sure to start filing your unemployment claim on the day you lose your job. You may feel overwhelmed by the whole situation, but it’s worth it to start filing as soon as you can. The process to receive unemployment can sometimes take a few weeks.

- Second Step: Look at What Savings You Have

Take a moment to look at what you have saved. Take inventory of your different accounts and what severance you may have gotten so you know how much you have and how long that might last you. For this type of situation, you can also dip into your emergency fund as losing your job unexpectedly definitely counts as an emergency.

- Third Step: Tighten Your Budget

Now that you have a better idea of what actual cold hard cash you have at your disposal before you are able to obtain a new source of income, you can plan out a tightened budget. Yes, it’s not pleasant, but cutting a few costs out of your budget for the next few months won’t kill you. Temporarily cut out all the expenses that aren’t essential, like subscriptions, gym memberships, cable, coffee, eating out, etc. By tightening the wallet, you ensure that your savings last until you are able to find a new job.

- Forth Step: Look After Your Debt

Next you should try to contact any creditors that you may have. If you reach out to them, they will be much more likely to help you out during a financial crisis. Lenders may offer options that could reduce or temporarily suspend your payments until you are employed again. The same goes for your student loans. If you call your student loan servicer, you could likely choose from several different options like deferment, forbearance, or an income-based repayment plan.

If you really don’t have enough savings to get you through this time, then maybe you need a loan to cover you until your unemployment kicks in. Whether you get a personal loan, credit union loan, title loan, or anything else, make sure you do your research so you’re aware of what you are getting yourself into before making any final financial decisions in the heat of the moment.

Get these things in order and then make job hunting your new full-time job. Following these steps is a sure-fire way to make things happen quickly. With determination and hard work, you won’t be unemployed for long and then you can get your finances back in order.

Image source: Eric Ferdinand

How Iban Wallet Contributes to Get Rid of Your Debts

In today’s fast-moving world, the cost of living is escalating at an alarming rate. Unfortunately, our incomes are not increasing at the same pace which often results in people taking up loans to cope with the rising costs. Before they know it, they find themselves spiralling down the debt hole unable to pay it off.

If you have old debts, paying them off should be a priority. Living a debt-free life not only means reduced stress but also gives you a better chance to withstand personal emergencies. It gives you enhanced ability to get on the path of financial freedom and build enough corpus that can take care of your financial needs. But how can you pay off your debts when your income remains the same but your debts keep on increasing? Enter investments.

Where to invest?

There are plenty of investment options that you can choose to park your money including savings account, fixed deposits, bonds, and more. With conventional investment options, the returns in the recent past have been quite unsatisfactory. For example, high-interest savings accounts offer interest rates between 1% and 2.20% while bond funds are known to fetch from 0.65% to 1.83% for mid-term. As investors, we all wish to earn the highest returns in the shortest time.

Fortunately, there are many investment platforms available today for investors or just average people who are looking for high returns. Not everyone has the time or technical ability to invest in mutual funds or stocks. While some others may have a low-risk tolerance. Investment platforms take care of all these factors and simply give you an option to invest in their product and watch your money grow with minimal efforts.

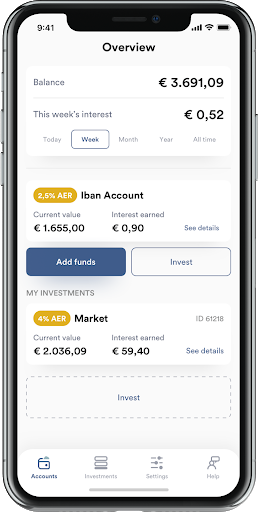

Iban Wallet is a global online investment platform that lets you earn fixed interest daily by investing in its different investment products. Depending on the product you pick, the interest rates vary from a projected 2.5% AER to 6% AER. You could earn this interest daily and get it credited to your account. What’s even better is the real-time notifications that inform you on transactions you make or the earnings on your Iban account. Another benefit of earning fixed interest daily is that you can calculate your earnings and plan how much you wish to save. This allows you to plan well in advance and chalk out how you can clear all your existing debts in a phased manner.

Many a time, investors hesitate or delay investing their money because they feel it requires a lump sum amount to grow or earn decent returns. But with Iban, you can start investing for as low as €/$1. The low investment requirement serves as an encouragement for small investors or those who do not have enough savings in their bank accounts. Besides, you can request to withdraw money whenever you need it. So, your funds are not locked-in, and you can use them in case of emergencies. Other traditional forms of investments such as fixed deposits or bonds may not provide such high liquidity to investors.

Another major criteria before choosing an investment product is safety. After all, you need to be sure that your money is going nowhere and you can trust the investment platform. Keeping the security and safety of investors‘ funds in mind, Iban has put in place three-layer risk mitigation and investor protection policy that ensures your investments remain safe. Even in the unlikely event that a loan borrower defaults, your money is protected through Asset-backed Loans, a Buyback Guarantee and a Safeguard Trust.

Conclusion

To conclude, alternative investment platforms are an effective way to earn high returns, clear off your debts and take control of your personal finance.