I think we can all agree that most debt is bad. Some of us might even agree that all debt is bad. Nearly all of us will also agree that nearly all of us have debt. It’s not a comfortable thing to have usually, and, since you’re reading this, I can only assume that you’re dedicated to paying it off like I am.

Like the debt conquistadors before us, we’ve learned that knowing your debt is key to besting your debt. You can’t win a race without knowing where it starts and where it ends. But, somehow, you’ve also got to be able to track yourself along the way. You’ve got to track your debt, and track your progress in paying it off.

Many of my indebted blogging friends have gone so far as to track their debt on their blog. Many of them have even gone so far as to create a nice progress bar that we can easily see how far they’ve made it. I don’t do that. Not because I’m embarrassed by the debt, or the progress we’ve made, but because I decided years ago that I wanted to keep it private. You don’t need to know how much debt I have any more than I need to know how much you have. We aren’t in a race against each other, and I surely don’t want anyone feeling badly about how much debt I have and trying to catch up. 😉

No matter how you go about it, keeping track of your progress as you pay off your debt is important. If you’ve been reading Beating Broke for long, you’ve probably gathered that I’m a fan of budgets. I think they’re a useful tool to help people like me keep track of what they spend and where they spend it. Budgets have helped me get control of my finances and move them in the right direction. So, it’s only natural that I use my budgeting software (YNAB) to keep track of how much I owe and where.

No matter how you go about it, keeping track of your progress as you pay off your debt is important. If you’ve been reading Beating Broke for long, you’ve probably gathered that I’m a fan of budgets. I think they’re a useful tool to help people like me keep track of what they spend and where they spend it. Budgets have helped me get control of my finances and move them in the right direction. So, it’s only natural that I use my budgeting software (YNAB) to keep track of how much I owe and where.

There are tools all over the place to help you track your debt. One of the sponsors of the Debt Movement, Ready for Zero, is a great tool to not only help you keep track of what you owe, but to also help you plan how you’ll pay it off. Tools like Mint also do a really good job of giving you an online tool to track your debt (and other accounts). I don’t use any of them. Mostly because I haven’t come across one that actually connects to all of my accounts. My local accounts at a credit union that is small enough to not be fully integrated (I guess) with the services that those sites and apps use to update accounts.

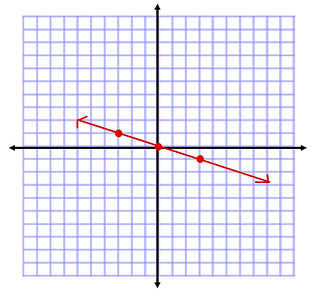

If you want to go really frugal, a simple spreadsheet can do the trick. Just list out all of your accounts, how much you owe on them and then update it as you make payments. Want to make it fancier? Track them monthly, then make a colorful line graph of your progress.

It doesn’t matter what tool you use. The point is that you track your debt. Know where you started with your debt, and then track your progress as you make your payments and pay it down. Even if you aren’t paying off accounts every month, it helps with motivation to keep going.

How do you track your debt?

img credit:blamevaraia on Flickr

I started this blog to share what I know and what I was learning about personal finance. Along the way I’ve met and found many blogging friends. Please feel free to connect with me on the Beating Broke accounts: Twitter and Facebook.

You can also connect with me personally at Novelnaut, Thatedeguy, Shane Ede, and my personal Twitter.

We only have two debts, our mortgage and a student loan. I have a tab in the Excel spreadsheet that I use which tracks the debt on a monthly basis. I can track our ‘debt’ history for over 7 years. I also track on a month to month basis the percentage of debt we paid down, and track an annual July-to-July snapshot showing a yearly progress. I also throw in ‘average debt’ paid down over the last 12 months.

All of these things provide short term and long term progress on our debt.

I try to keep it simple and automatic, although I only have a small mortgage and a car loan. I set up automatic payments with my online account adding additional principle payments. I will have my debt paid off by the time I retire in 5 years.

Am I tracking my debt? Definitely! We are on the last few hundreds of our bank loan, the last debt we have to pay, and we are positive that it will be paid off within the first quarter of this year. Let’s keep our fingers crossed!

I am tracking my debt with an Excel spreadsheet and will starting a blog to track my progress and give me some accountability. I hope to pay off quite a bit of debt in 2013.

I use a new Windows 8 app called Debt Tracker.

Very easy to use and cool features: http://apps.microsoft.com/windows/en-us/app/debt-tracker/6605d6a4-d6fe-49cc-b176-ad943b3f4e5a