Living on a tight budget doesn’t mean you can’t save money—it just means you have to be clever about it. When every dollar counts, small changes can make a big difference in your wallet. Let’s explore some practical yet creative ways to save money, even when times are tough. These ideas will help you keep more cash in your pocket while still enjoying life.

Master Meal Planning

Planning meals ahead is one of the best ways to cut grocery bills on a tight budget. Instead of last-minute takeout or pricey pre-made meals, meal planning allows you to buy only what you need. Create a weekly menu, then shop with a list to avoid impulse buys. You’ll be surprised how much money you save by simply sticking to a plan.

Embrace Thrift Shopping

If you’re on a tight budget, thrift stores are your new best friend. From clothes to home decor, thrift stores offer gently used items at a fraction of the price. Not only do you save money, but you also contribute to a more sustainable lifestyle by reusing goods. Give secondhand shopping a try—you never know what treasures you’ll find.

Use Cash Instead of Cards

When money feels tight, using cash can help you stick to your budget. Withdraw the amount you’ve set aside for the week and avoid using your debit or credit card. With cash, it’s easier to track what you’re spending because you can see it dwindling in your wallet. This approach can be surprisingly effective in curbing overspending.

Cancel Unused Subscriptions

Subscriptions can sneak up on you, quietly draining your funds each month. Take a hard look at any services you’re not actively using, from streaming platforms to gym memberships. Canceling even a few can free up extra cash for essentials. On a tight budget, every penny counts, and cutting unnecessary expenses can provide some breathing room.

Cook at Home

Dining out can quickly drain your funds, especially on a tight budget. Cooking at home is a satisfying and cost-effective alternative that lets you control ingredients and portions. Experiment with budget-friendly recipes or try batch cooking to stretch meals across several days. You’ll be eating better and saving money at the same time.

DIY Cleaning Products

Store-bought cleaners can be costly, but DIY options are affordable and easy to make. With a few basics like vinegar, baking soda, and lemon juice, you can create effective cleaners for every room. Not only is this kinder to your wallet, but homemade cleaners are often eco-friendly, too. Save money while keeping your space fresh and clean.

Shop Generic Brands

Brand loyalty can be pricey, but generic alternatives often offer the same quality at a lower cost. Many stores provide their own versions of popular products that are easier on a tight budget. Compare ingredients and reviews to make sure you’re still getting value for your money. Choosing generic can lead to surprisingly big savings over time.

Plan “No-Spend” Days

On a tight budget, it’s helpful to designate specific days where you don’t spend any money at all. This practice encourages you to make the most of what you already have, whether it’s food, entertainment, or fuel. Use these days to reset and get creative with the resources on hand. No-spend days can be refreshing and bring you back to basics.

Adjust Your Thermostat

Heating and cooling costs can spike your utility bills. If you’re living on a tight budget, consider adjusting your thermostat a few degrees to save energy. Wearing layers in the winter or using fans in the summer can reduce your dependence on the HVAC. Small adjustments add up over time, helping you keep more money in your pocket.

Make Every Dollar Count

Living on a tight budget is a challenge, but it’s also an opportunity to build smarter money habits. With these strategies, you can find ways to save without feeling deprived. Each small change you make brings you closer to financial stability and gives you control over your finances.

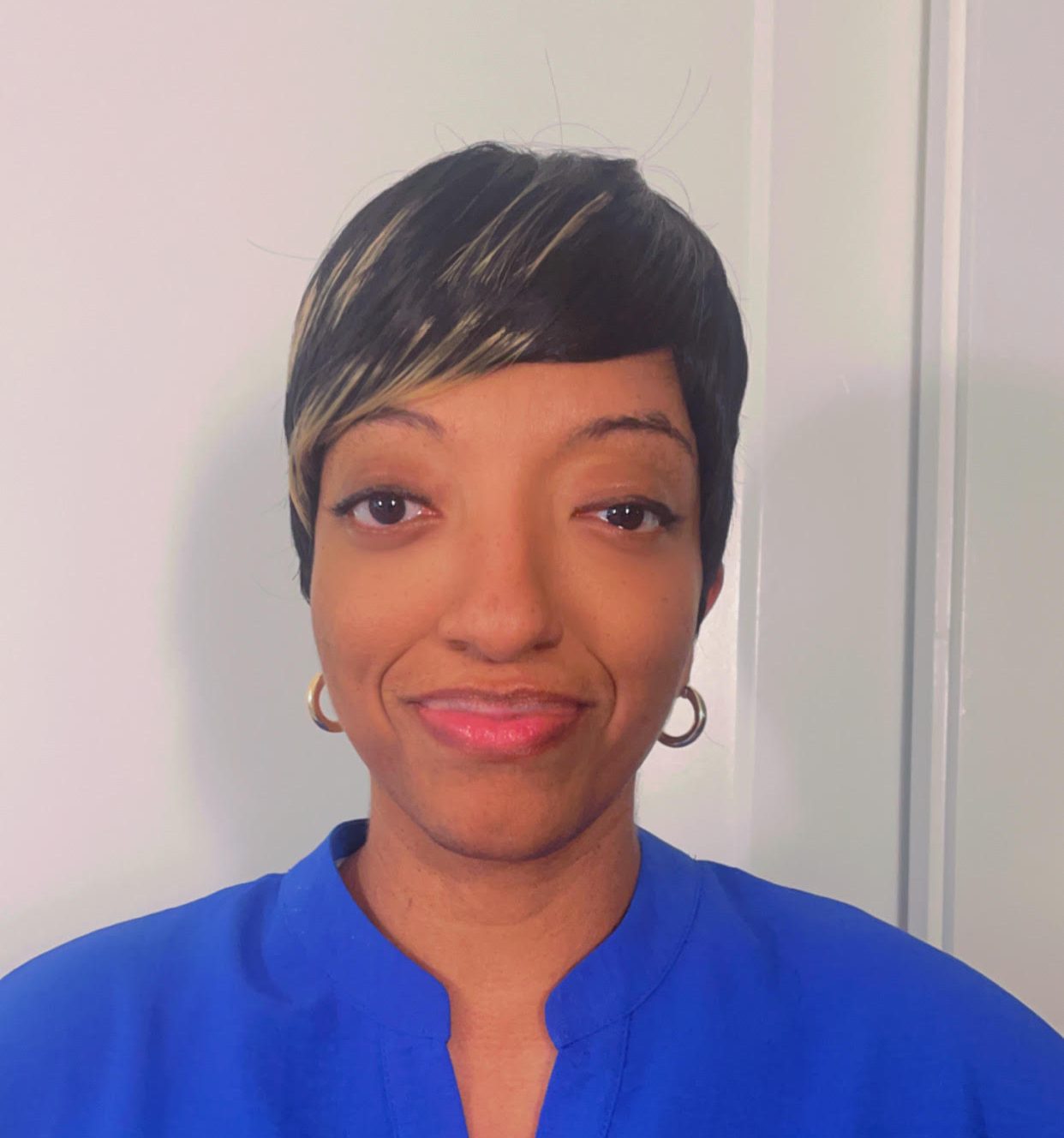

Latrice is a dedicated professional with a rich background in social work, complemented by an Associate Degree in the field. Her journey has been uniquely shaped by the rewarding experience of being a stay-at-home mom to her two children, aged 13 and 5. This role has not only been a testament to her commitment to family but has also provided her with invaluable life lessons and insights.

As a mother, Latrice has embraced the opportunity to educate her children on essential life skills, with a special focus on financial literacy, the nuances of life, and the importance of inner peace.

Leave a Reply