As I mentioned in my last post, I’ve been taking 10% of my income from my online ventures and splitting it between my Lending Club account and my Sharebuilder account. It’s been a bit of an experiment. Nothing scientific, but a test to see if I drop the same amount of money into each account, what the returns and stability would look like. My returns on Lending Club have been very good, and the stability has been good so far. Let’s take a look at the Sharebuilder account.

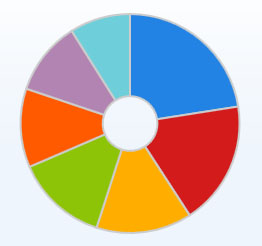

So far, I’ve got about $264 put into the account. (Yep, I’m a heavy hitter. 🙂 ) So far, I’ve got six investments that I’ve split the money between. There’s also about $50 that is in cash at the moment.

- ARCC

- CIM

- LTC

- MAIN

- NRGY

- TICC

If you’re like me, you’ve likely never heard of any of those. You’re probably more familiar with symbols like WMT, MSFT, APPL, or C. One thing they have in common, is that they’re all dividend paying stocks. I like that. As time goes on, I’ll be balancing out these lesser known stocks with some other, more familiar dividend paying stocks. For now, that’s what the portfolio looks like. They’re all pretty evenly split as far as portion of portfolio invested. So far, the only one that is in the green is MAIN, and just barely.

Currently, my Sharebuilder account is showing a -13.30% return.

The Sharebuilder account is getting a bit of a bad rap here. Part of the reason that the return is so abysmal is that I’ve got a $260 portfolio split up into 6 stocks. Each purchase comes with a $4 fee. So, right away, the investments have to overcome a $24 loss. Take that $24 out of the equation, and the account is only down a few bucks, and the return, while still negative, is far less so. That also brings us to the cash that’s sitting in the account. Previously, I would make a purchase when the balance got over $34, so that, once the $4 fee was taken, I was still buying $30 worth of the stock. After seeing what that was doing to the results, I’ve changed that, and will likely start making purchases in $50-$60 lots. It will take longer to build the portfolio, but the impact of the fee will be lessened.

Overall, there really isn’t much comparison of the returns between the Lending Club and Sharebuilder accounts. Taken on their face, Lending Club wins hands down. I have to add, however, that the investments available in the two are very different. For the most part, you won’t lose an investment in Sharebuilder. Unless you invest in the next Enron, that is. With Lending Club, the risk is higher, because a borrower could default on the loan and you could lose all of that money if they do. But, there’s an obvious trade-off here. For the higher returns of Lending Club, you have higher risk. Less risk, with Sharebuilder, gets you less returns. Simple as that. I’ll likely continue doing both, for a while and see what the 1 year comparison looks like in July.

Have you ever used Sharebuilder? Where do you put your investments? Do you have a “fun” account like my Sharebuilder account?

Shane Ede is a business teacher and personal finance blogger. He holds dual Bachelors degrees in education and computer sciences, as well as a Masters Degree in educational technology. Shane is passionate about personal finance, literacy and helping others master their money. When he isn’t enjoying live music, Shane likes spending time with family, barbeque and meteorology.

I use Sharebuilder too. I have a joint trading account (which I opened to get a bonus), a Roth IRA account and a traditional IRA account. I just started investing in there last July (and the market basically pooped out between then and December), so I’m just now getting back to even.

Overall, I Sharebuilder has a good website and makes trading easy. Also, for what it’s worth, I try to buy at least $200 of stock at a time because I read somehwere that you should try to limit your fees from stock buying to 2% or your investment or less.

I use Sharebuilder. I’m currently in the process of transferring my IRAs over.

Right now, the majority of my Sharebuilder money is in BAC, which has seen a 20% increase in the last few weeks.

I used to have a Sharebuilder account but it didn’t really suit my needs. The fee structure was closely tied to regular investments and at the time, I wasn’t able to save enough to make the fees economical. I moved to FolioFn and it has been a much better fit.

You mention a very important consideration when investing, take trading fees into account when planning a buy. My rule of thumb has always been to keep my trading fees at <2% of any given transaction. It's much easier to recoup 2% than a 10% loss.

As a Canadian, we do not have access to ShareBuilder. However, we do still invest in broad market indexes and quality, dividend paying stocks. Keep plugging away….your balance will continue to grow.

I haven’t explored sharebuilder as yet, I guess I’m just old fashioned but I like to be able to talk to a real person about my investments.

@Marie, There’s something to be said with being able to sit, face-to-face, with an adviser who knows your finances. For me, at least, I don’t have the funds to really worry about that all that much. But, that’s part of the reason that I haven’t rolled my old 401(k) over, it would increase the amount by a lot!